Download Avaya.7495X.PracticeTest.2019-04-01.28q.tqb

| Vendor: | Avaya |

| Exam Code: | 7495X |

| Exam Name: | Avaya Oceana Solution Integration Exam |

| Date: | Apr 01, 2019 |

| File Size: | 225 KB |

Demo Questions

Question 1

AVA is required for providing which two integrations for Avaya Oceana® 3.5 solution? (Choose two.)

- Avaya Chatbot

- Avaya Mobile Video

- Webchat

- SMS

- Social Media

Correct answer: AC

Explanation:

Reference: https://downloads.avaya.com/css/P8/documents/101054790 Reference: https://downloads.avaya.com/css/P8/documents/101054790

Question 2

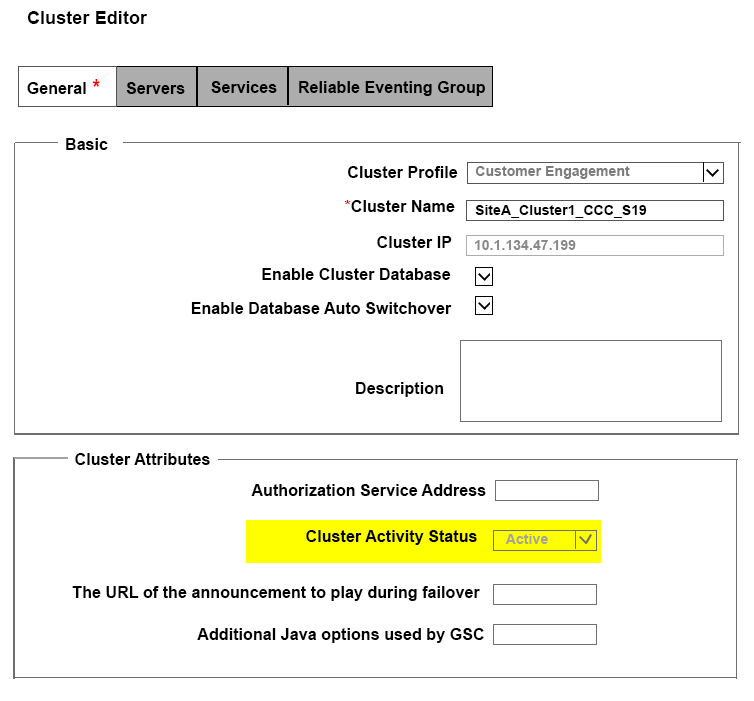

Refer to the exhibit.

A customer has Data center 1 (DC1) and they would like to implement Data Center 2 (DC2) as the DR solution.

While deploying the Avaya Oceana® DR solution, which two configuration items are applicable to the DR site? (Choose two.)

- The Breeze ™ clusters on DC2 must be set to “Accept new Service” mode through System Manager.

- The Breeze ™ clusters on DC2 must be set to “Accept new Service” set as “Active” using the cluster attributes within System Manager.

- The Breeze ™ clusters on DC1 must be set as “Standby” using the cluster attributes within System Manager.

- The Breeze ™ clusters on DC2 set as “Standby” using the cluster attributes within System Manager.

- The Breeze ™ clusters on DC2 must be set to “Deny new Service” mode through System Manager.

Correct answer: CE

Question 3

A customer’s recommendation is to use secure communication between all the components involved in the Avaya Oceana® solution.

After enabling secure communication for a cluster, which additional configuration parameter needs to be updated for the cluster?

- Cluster Profile

- Cluster group

- Cluster IP

- Cluster Fully Qualified Domain Name

Correct answer: C